GST Registration & Returns

Hassle-free GST registration and accurate return filing services designed to keep your business compliant at every stage.

GST Registration & Returns

Requirements

Process

Documents

Why

Finance Shelter ?

FAQ's

Overview

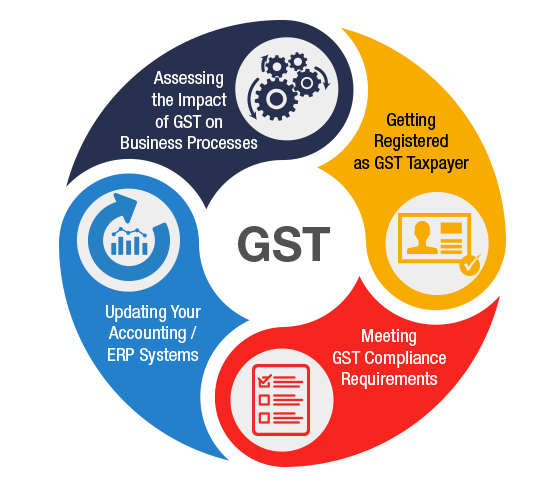

GST Registration and Return filing in India are essential for businesses exceeding the prescribed turnover or engaging in taxable supplies. Governed by the Goods and Services Tax laws, GST registration enables businesses to collect tax legally, claim input tax credit, and comply with statutory requirements. The process involves submitting business and identity documents, followed by regular filing of monthly, quarterly, or annual returns based on the applicable GST scheme. Timely and accurate filings are crucial to avoid penalties, interest, and compliance issues.

Finance Shelter simplifies GST registration and return filing by offering end-to-end support, from application and documentation to ongoing compliance management. Our experienced professionals ensure accurate filings, adherence to deadlines, and up-to-date compliance with GST regulations, while maintaining transparent pricing and a smooth, hassle-free experience for businesses of all sizes.

The process involves timely submission of various returns based on business type, turnover, and filing frequency. Staying updated with changing GST regulations and meeting filing deadlines is critical to ensure uninterrupted business operations and regulatory compliance.

What is GST Registration & Return?

GST Registration is the process of enrolling a business under the Goods and Services Tax system, allowing it to collect tax and claim input tax credit. GST Return refers to the periodic filing of sales, purchases, tax collected, and tax paid details to remain compliant with GST laws.

Mandatory requirements for GST Registration & Return

Requirements

GST registration and return filing need proper business documentation, identity proofs, bank details, and accurate records to stay compliant.

Business Eligibility

The business must meet GST turnover limits or fall under mandatory registration rules.

Regular Compliance

GST returns must be filed on time, even if there are no transactions (Nil return).

Business Records

Sales, purchase, and expense details are needed for correct registration data and return filing.

Online Portal Access

The taxpayer must have access to the GST portal to complete registration and submit returns electronically.

How to Register for GST and File Returns in India?

Here’s how to register a business under GST and comply with return filing requirements, regulated by the Goods and Services Tax laws in India:

1.Check Eligibility – Determine if your business exceeds the GST turnover threshold or falls under a category that requires mandatory registration.

2.Collect Required Documents – Gather PAN, business proof, identity and address proofs, bank details, and a digital signature or Aadhaar OTP.

3.Submit GST Registration Application – Fill out the GST REG-01 form online on the GST portal with the required details and documents.

4.Verification & Approval – The GST officer verifies the application and documents. Upon approval, a GSTIN (GST Identification Number) is issued.

5.Maintain Sales & Purchase Records – Keep accurate records of all invoices, purchases, and sales to calculate tax liability and input tax credit.

6.File GST Returns – Submit periodic returns (monthly, quarterly, or annual) on the GST portal, reporting sales, purchases, tax collected, and tax paid.

7.Ensure Timely Compliance .– Pay any due GST on time and file returns within deadlines to avoid penalties and interest.

This GST registration ensures your business remains fully compliant, can legally collect tax, and claim input tax credit seamlessly.

Please note: The process usually takes 3 to 7 working days.

Documents required for GST Registration & Return

PAN Card

Primary identity document for GST registration and returns.

Aadhaar Card

Used for identity verification of the applicant.

Business Address Proof

Confirms the place of business.

Sales Invoices

Shows outward supplies and tax collected.

Purchase Invoices

Bank Account Proof

Verifies business bank details for GST.

Key Advantages of GST Compliance for Modern Businesses

Benefits of GST Registration & Return Filing

Legal Recognition of Business

GST registration provides legal recognition to a business under Indian tax laws. It allows the business to operate lawfully and comply with government regulations.

Input Tax Credit (ITC) Benefit

Registered businesses can claim input tax credit on GST paid for purchases. This reduces the overall tax liability and lowers the cost of operations.

Interstate Business Made Easy

GST registration allows businesses to sell goods and services across state borders without restrictions, helping them expand their market reach.

Avoidance of Penalties & Legal Issues

Timely GST registration and regular return filing help avoid heavy penalties, interest charges, and legal complications imposed by tax authorities

Why Finance Shelter for GST Registration & Return Filing?

GST registration and timely return filing are crucial for running a compliant and growing business in India. Finance Shelter offers expert-driven, end-to-end GST solutions tailored to your business needs.

End-to-End GST Registration Support

From document collection to GST portal application and approval, Finance Shelter manages the complete GST registration process smoothly and efficiently.GST Documentation & Compliance Assistance

We assist with accurate preparation of required documents such as PAN, address proof, bank details, and business registration proofs to ensure error-free submission.GST Return Filing & Ongoing Compliance

Our team handles monthly, quarterly, and annual GST returns, ensuring timely filing to help you avoid penalties, interest, and compliance issues.Input Tax Credit (ITC) & Tax Advisory

Finance Shelter helps you maximize eligible input tax credit and provides expert guidance on GST rates, classifications, and tax planning.Dedicated Support for Growing & Existing Businesses

Whether you’re a startup, small business, or expanding enterprise, we offer personalized GST solutions, including amendments, notices handling, and compliance updates.

Frequently Asked Questions

Common Questions About GST Registration & Return Filing

Any business with turnover exceeding the prescribed GST threshold, or engaged in interstate supply, e-commerce, or taxable services, must obtain GST registration as per GST laws.

GST returns can be filed monthly, quarterly, or annually depending on the business type and turnover. Finance Shelter ensures timely filing as per applicable GST norms.

Late filing of GST returns may attract penalties, interest charges, and suspension of GST registration. Regular compliance helps avoid legal and financial risks.